The number of drivers using dash cam footage to help with insurance claims has soared by 92% over the last two years, according to a new survey by Allianz Australia. The insurer says more than 20% of Australian drivers are recording their car trips, with a sharp increase in popularity in the past year. The […]

How you can prevent cyber-crime from crippling your company

Email compromise, where a scammer impersonates a business to request payments be transferred into a scammer’s bank account, cost Australian businesses over $60 million in losses in 2018, a 170 per cent increase of $22.1 million in 2017. Vigilance is key to protecting your business’s most valuable assets and this should be a year-long objective. […]

Bushfires Checklist – What to do

As summer approaches we start thinking about the potential threat of bushfires throughout Australia. A devastating time for everyone involved. It is worth thinking about what to do if you are at risk of a bushfire. The dry summer months are the danger time for bushfires in southern Australia, while northern Australia is most at […]

Out-of-season bushfires ‘fuelled by climate change’

Out-of-season bushfires tearing through NSW and Queensland reveal the “inescapable truth” of the impact of climate change, IAG says. Hundreds of fires have been reported and the Insurance Council of Australia (ICA) declared a catastrophe with losses already at $13.5 million. Conditions eased today, however dozens of fires are still burning across the two states. […]

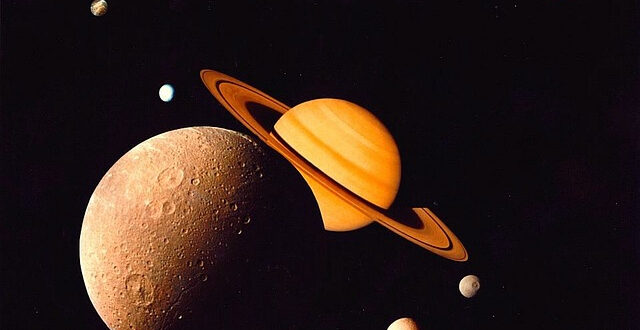

Quite Interesting!

Lakes of methane on Saturn’s moon Titan may be the craters of giant explosions, a new study shows A new study suggests that the liquid methane lakes that dot Titan’s surface may have formed when pockets of warming nitrogen exploded below the moon’s surface. This idea would solve a mystery that emerged when NASA’s Cassini […]

Insurance council recommends travellers check insurance for ...

The Insurance Council of New Zealand (ICNZ) has advised travellers to check with their insurers in order to find out what they’re actually covered for so they would better understand their options. The NZ Herald brought the topic to light after a Jetstar passenger was surprised to learn that their travel insurance covers hijack and […]

Your future customers: How to crack the gen Z code

For too long, marketers have centred their practices around appealing to a millennial market. Unfortunately, this has left the advertising community deeply unprepared for the rise of the generation Z customer base. While some marketing principles may apply to both groups, what entices a 35-year-old to purchase a product or service will be quite different […]

Experts concerned about increasing frequency of deepfake att...

Fraudsters are increasingly using technology to doctor their voices and faces in a con technique called “deepfake” – and cyber security experts and insurers are warning companies to make sure that they have the necessary safeguards in place. Deepfake attacks involve criminals using artificial intelligence (AI), machine learning, and other technologies to impersonate a company’s […]

6 carmakers that are betting electric scooters and bikes — n

Carmakers are increasingly looking towards new ways to move people around, including tapping into the rising trends of e-bikes and e-scooters. Audi announced on Monday the development of its e-tron Scooters, almost a year after announcing its fully electric e-tron SUV. Other carmakers, like BMW and Ford, have already been exploring the electric personal micro-mobility […]

Water damage claims topping fire, burglary

The size of household internal water damage claims has risen 72% in the last five years and the issue is now a more common and costly risk for properties than burglary or fire, Chubb says. The average claim size received by Chubb Australia jumped to $30,361 last year from $17,627 in 2014 as changing home […]

Latest Articles

Tools & Tips to Handle Summer Weather Risks Effectively

Don’t Let Business Blindspots Catch Your SME Off Guard

Happy Chinese New Year 2026

Protecting Tradies is Good for Your Business

Is Your Business Ready for the Next Grey Rhino?

Happy New Year

Seasons greetings

The Annual Risk Health Check: Why Every SME Needs It

No Office, No Servers—No Insurance? Think Again

DISCLAIMER

This web site is designed primarily for use by Australian residents. Therefore, some products referred to in this site may be inappropriate for overseas residents. Please contact us via e-mail or phone to discuss your needs should you not be an Australian resident.

The information on this site is for general information purposes only and you should first seek advice from us to determine which products and services are most appropriate for your needs. We take our responsibilities to you seriously, and will work closely with you to customise your program to suit your needs.